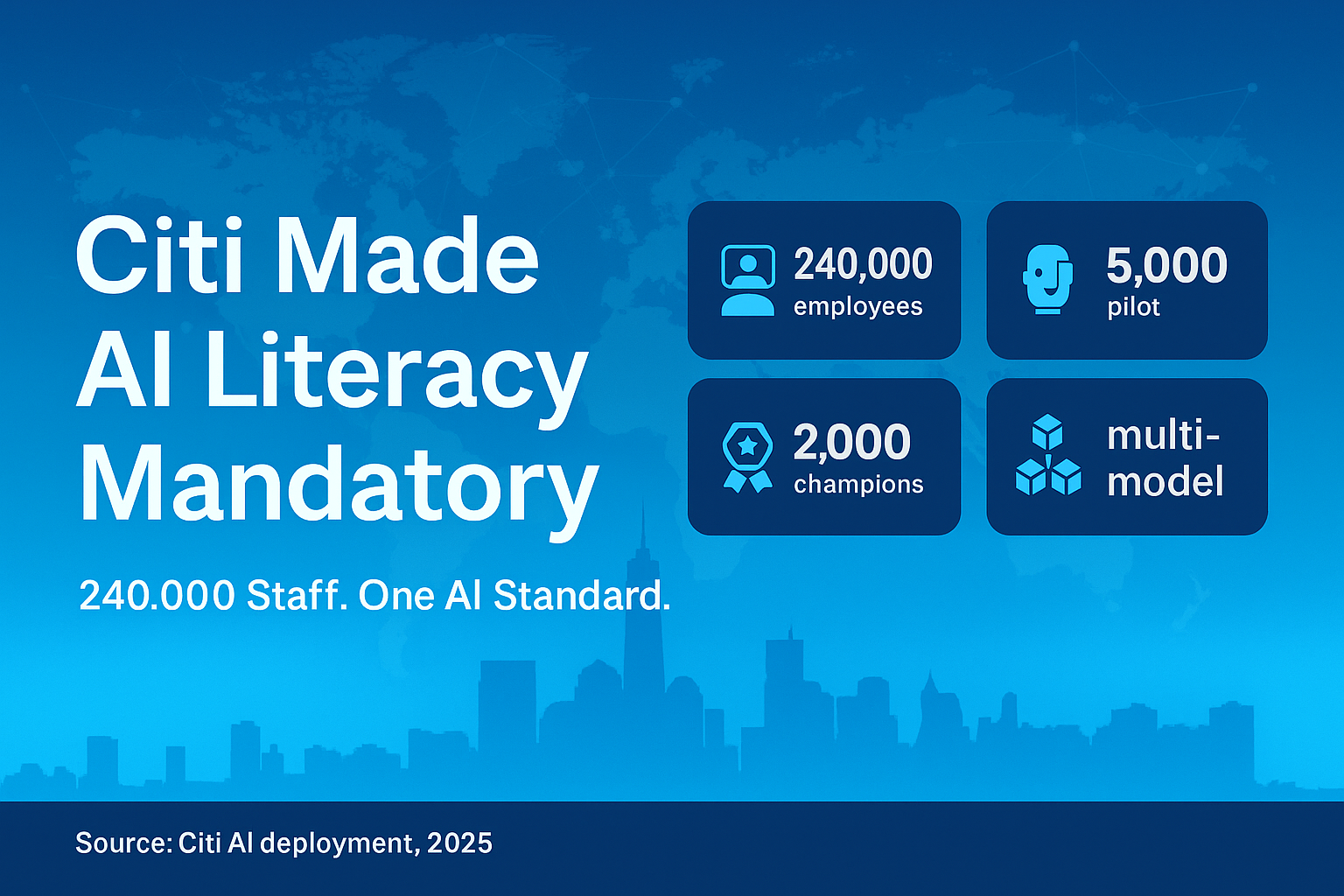

Citigroup didn’t pilot AI with a small team to test feasibility. They deployed agentic AI to 5,000 employees simultaneously across the US, UK, India, and Canada through their Citi Stylus Workspaces platform. Not for experimentation. For actual work: client profiling, report generation, and complex workflow automation executed through single natural language prompts.

The scale reveals strategic thinking. Most banks carefully pilot AI with dozens or hundreds of users, gather feedback for months, then cautiously expand. Citi went straight to thousands of users across global operations, treating AI deployment as an operational imperative rather than a technology experiment.

The mandatory AI literacy requirement for all employees signals even more ambitious intentions. You don’t make training mandatory for technology you’re still evaluating. You make it mandatory for capabilities you’ve decided are fundamental to how your organization will operate going forward. Citi isn’t testing whether AI matters. They’ve already concluded it does and are moving to ensure their entire workforce can leverage it.

The Internal Knowledge Access Problem

Large financial institutions accumulate decades of internal documentation: compliance procedures, risk frameworks, product specifications, operational guidelines, and policy manuals. This institutional knowledge exists primarily in static documents scattered across systems that require knowing exactly what you’re looking for to find relevant information.

An employee needing to understand a specific compliance requirement might search through hundreds of pages of policy documents, legal memos, and procedural guides. If they don’t know the precise terminology used in the documentation, they might never find the information despite it being readily available. The knowledge exists but remains functionally inaccessible because retrieval requires expert-level understanding of documentation structure.

Traditional solutions involved training employees on documentation systems and maintaining extensive reference libraries. This worked poorly because people can’t remember where every piece of information lives across massive document repositories. The practical result was employees repeatedly asking colleagues for information rather than finding it themselves, creating bottlenecks around people with deep institutional knowledge.

Citi Assist addresses this through natural language querying of internal systems. An employee can ask “What are the documentation requirements for cross-border transactions over $1 million?” and receive relevant policy information without needing to know which specific documents contain that guidance or what technical terminology the documentation uses.

This seemingly simple capability transforms organizational efficiency. Questions that previously required 20 minutes of document searching or waiting for colleague responses get answered in seconds. Employees stop interrupting each other for basic information retrieval. Institutional knowledge becomes democratically accessible rather than concentrated in specific individuals.

The compounding effect across 240,000 employees creates substantial productivity improvement. If each employee saves just 15 minutes daily through faster information access, that’s 60,000 hours saved daily or roughly 15 million hours annually. At fully loaded employee costs of $100-200 per hour, the annual value ranges from $1.5-3 billion in recaptured productivity.

The Agentic AI Workflow Revolution

Agentic AI differs fundamentally from previous generations of automation. Traditional automation executes predetermined workflows: if input A, then perform steps B, C, D to produce output E. This works for standardized processes but fails when tasks require judgment, adaptation, or handling exceptions.

Generative AI chatbots improved on this by providing conversational interfaces and natural language understanding but still required humans to direct each step. An employee might ask an AI assistant to draft an email or summarize a document, but the human decides what needs doing and sequences the work.

Agentic AI takes instructions at a higher level of abstraction and independently executes multi-step workflows. A banker can tell the system “Prepare a comprehensive client profile for prospect X including financial position, investment history, risk tolerance, and relevant product recommendations” and the AI autonomously gathers data from multiple internal systems, analyzes the information, generates insights, and produces a formatted report.

The workflow might involve querying customer relationship management systems, accessing transaction histories, reviewing compliance records, analyzing risk assessment data, and synthesizing everything into coherent recommendations. Traditional automation would require explicitly programming each step and decision point. Agentic AI figures out the necessary steps based on the high-level objective.

This capability transformation changes what tasks are worth automating. Previously, only high-volume standardized processes justified automation investment because programming complex workflows was expensive. Agentic AI makes automation economical for tasks that happen occasionally but require substantial manual effort when they do occur.

The 5,000-employee pilot tests this across diverse use cases simultaneously. Different departments face different workflow challenges. Having thousands of users attempting various tasks generates diverse feedback about capabilities and limitations faster than small carefully controlled pilots. Citi learns what works at scale rather than what works in idealized test conditions.

The 2,000 AI Champions Strategy

Deploying AI across 240,000 employees globally requires more than just technology. It requires organizational change management at unprecedented scale. Citi’s network of over 2,000 AI Champions embedded across departments creates the human infrastructure enabling technological adoption.

These champions aren’t traditional IT support staff. They’re domain experts in their respective departments who also understand AI capabilities and limitations. A compliance AI champion knows compliance workflows deeply plus how AI tools can enhance those workflows. They identify use cases, train colleagues, gather feedback, and facilitate continuous improvement.

This distributed expertise model solves the fundamental challenge that centralized AI teams face: they understand technology but lack deep context about how work actually happens across diverse departments. AI champions bridge this gap by combining domain expertise with AI literacy, ensuring AI tools get deployed in ways that genuinely improve work rather than just demonstrating technical capability.

The champion network also accelerates learning propagation. When an AI champion in one department discovers an effective use case or best practice, they share it through the network, enabling rapid adoption across other departments facing similar challenges. This creates exponential learning where insights accumulate across the organization rather than remaining siloed within specific teams.

The scale of the champion network (2,000 individuals) relative to the employee base (240,000) means roughly one champion per 120 employees. This ratio ensures most employees work relatively close to someone who can provide hands-on AI guidance and support, reducing the friction of adopting new tools and workflows.

I’ve observed similar champion networks in enterprise software deployments where distributed domain experts dramatically improved adoption rates compared to centralized training programs. The key is having AI literacy embedded within teams rather than treating it as an external capability that people access when they have problems.

The Mandatory Literacy Requirement

Making AI literacy and prompt engineering training mandatory for all staff represents one of the most aggressive AI adoption stances in banking. Mandatory training signals leadership’s belief that AI capabilities will be fundamental to job performance rather than optional enhancements.

This contrasts sharply with typical enterprise AI adoption where companies provide training but allow employees to opt out or ignore new tools while continuing to work using familiar methods. Permissive approaches lead to uneven adoption where technically inclined employees embrace AI while others avoid it, creating capability gaps within teams.

Mandatory training ensures baseline AI literacy across the entire workforce. Everyone understands what AI tools can do, how to interact with them effectively, and when to use them versus relying on traditional methods. This universal literacy creates network effects where teams can collaborate assuming shared AI capabilities rather than working at the lowest common denominator of whoever has least AI experience.

The prompt engineering focus particularly matters for agentic AI deployment. Getting good results from AI systems requires understanding how to formulate requests effectively: being specific about desired outputs, providing necessary context, and iterating on prompts to refine results. Poor prompts generate poor results, leading users to conclude the AI doesn’t work rather than recognizing their own prompting needs improvement.

Training all employees in prompt engineering prevents this failure mode where people try AI tools once, get disappointing results due to poor prompts, then abandon the technology. Instead, they learn to interact effectively with AI from the start, experiencing the genuine capabilities rather than being frustrated by their own ineffective usage.

The mandate also sends cultural signals about Citi’s strategic direction. When leadership requires training, employees recognize that AI proficiency will affect their career progression. This motivates serious engagement with training rather than treating it as optional professional development that people complete perfunctorily.

The Compliance and Risk Integration

Financial services face intense regulatory scrutiny around AI deployment. Regulators worry about algorithmic bias, explainability of AI decisions, data privacy, and systemic risks from widespread AI adoption. Banks deploying AI aggressively must demonstrate robust governance and risk management.

Citi’s approach integrates AI tools directly into compliance and risk functions rather than treating them as separate technology initiatives requiring oversight. Compliance teams use AI to improve their work: analyzing regulatory changes, reviewing transactions for suspicious patterns, and ensuring adherence to policies. Risk teams leverage AI for portfolio analysis, stress testing, and monitoring exposures.

This integration creates natural incentives for effective governance. When compliance and risk teams rely on AI for their own work, they’re motivated to ensure the technology operates reliably and transparently. They become sophisticated AI users who understand capabilities and limitations firsthand rather than external overseers trying to govern technology they don’t directly use.

The approach also identifies governance needs through actual usage rather than theoretical risk assessment. When compliance teams discover AI limitations or potential risks through daily use, they can implement controls based on real operational experience rather than speculative concerns that might not materialize in practice.

The emphasis on continuous monitoring for performance, reliability, and compliance reflects mature thinking about AI governance. Early AI deployments often focused on initial approval processes: ensuring systems met standards before deployment. Continuous monitoring recognizes that AI systems can drift over time as data distributions change or as users discover unexpected failure modes.

The Wealth Management Application

AI-powered advisory platforms in wealth management represent particularly high-value applications because personalized financial advice traditionally required expensive human advisors, limiting it to high-net-worth clients. AI makes personalized advice economically viable across broader client segments.

Traditional wealth management operates through human advisors who build relationships with clients, understand their financial goals and risk tolerance, and provide customized investment recommendations. This model works well for clients with sufficient assets to justify advisor attention but leaves mass-market clients with generic investment products lacking personalization.

AI advisory platforms analyze client financial situations, investment histories, stated goals, and risk profiles to generate personalized recommendations at scale. A client with $50,000 in investable assets gets analysis and advice comparable to what millionaires receive from human advisors because the marginal cost of AI advice approaches zero regardless of account size.

The economic transformation is substantial. If a human advisor can effectively serve 100 high-net-worth clients, their minimum viable account size might be $1-2 million to generate sufficient revenue. AI advisory platforms serve unlimited clients regardless of account size, making wealth management profitable for middle-market segments that traditional models couldn’t economically address.

This doesn’t eliminate human advisors. It changes their role from providing basic advice to all clients to focusing on complex situations, relationship management, and emotional support during market volatility where human judgment and empathy matter most. The AI handles routine analysis and standard recommendations while human advisors focus on situations requiring nuanced judgment.

The Multi-Model Integration Strategy

Citi explicitly works with multiple AI models rather than standardizing on a single provider. This multi-model approach reflects sophisticated understanding of AI capabilities and strategic risk management.

Different AI models excel at different tasks. Some perform better on technical analysis, others on natural language generation, and others on reasoning and planning. Using the best model for each use case rather than forcing a single model to handle everything improves overall system performance.

The multi-model strategy also reduces vendor dependence and manages technology risk. If Citi standardized on a single AI provider and that provider’s technology fell behind or faced availability issues, Citi’s entire AI capability would be impacted. Supporting multiple models creates redundancy and optionality to shift workloads if specific models underperform.

This approach requires more sophisticated infrastructure and management than single-vendor strategies. Citi must integrate multiple APIs, manage different prompting approaches, and monitor performance across diverse models. This complexity investment pays off through flexibility and risk reduction.

The strategy also positions Citi to rapidly adopt improving AI capabilities. As new models emerge with superior performance, Citi can integrate them incrementally rather than facing all-or-nothing decisions about switching providers. This nimbleness allows capturing AI improvements faster than competitors locked into single-vendor strategies.

The Global Deployment Complexity

Rolling out AI tools simultaneously across the US, UK, India, and Canada introduces substantial complexity that many organizations avoid by limiting initial deployments to single regions. Citi’s multi-region approach accelerates learning but requires managing diverse regulatory environments, data residency requirements, and cultural differences.

Financial services regulations vary significantly across jurisdictions. AI systems approved in one country might face restrictions in others. Data privacy rules like GDPR in Europe impose requirements that differ from US regulations. Citi must navigate these differences while maintaining consistent AI capabilities globally.

The multi-region deployment also tests AI systems across diverse operational contexts. Banking workflows differ between regions due to local market practices, product offerings, and customer expectations. AI tools that work well in US operations might perform poorly in India if they’re not adapted for local context.

This complexity investment generates valuable insights about building globally scalable AI capabilities. Rather than discovering regional adaptation requirements when expanding from initial single-region deployments, Citi identifies them upfront during the pilot phase. This front-loads learning that would otherwise emerge gradually during multi-year rollouts.

The global deployment also demonstrates commitment to AI transformation that goes beyond experimenting in limited contexts. Starting with global reach signals that AI capabilities will be foundational across all operations rather than regional enhancements in specific markets.

The Competitive Dynamics Shift

Citi’s aggressive AI deployment creates pressure across the banking industry. Competitors observing Citi’s initiatives face strategic questions about their own AI adoption pace and ambition. The banks that respond quickly might maintain competitive parity. Those that delay risk permanent disadvantages in operational efficiency and customer service capabilities.

The advantage compounds because AI capabilities create data flywheels. As Citi’s AI systems get used extensively, they generate training data that improves performance. Models learn from millions of employee interactions, becoming more effective at understanding requests and generating useful outputs. Competitors starting similar initiatives later lack this accumulated learning.

The talent dynamics also favor early adopters. Citi positions itself as an AI-forward employer, attracting technologically sophisticated candidates who want to work with cutting-edge tools. Banks perceived as lagging in AI adoption might struggle recruiting talent that expects modern technology environments.

The mandatory AI literacy requirement particularly creates competitive pressure. As Citi’s entire workforce develops AI proficiency, their operational capabilities diverge from competitors whose employees lack similar skills. This workforce capability gap becomes increasingly difficult to close as Citi’s employees accumulate years of experience working with AI while competitors’ employees continue using traditional methods.

The Operational Excellence Vision

Citi frames AI integration as part of broader digital transformation focused on operational excellence. This positioning differs from viewing AI as either pure cost reduction or speculative innovation. Operational excellence means consistently delivering superior service at competitive costs, which AI enables through efficiency gains and enhanced capabilities.

The vision recognizes that financial services increasingly compete on operational efficiency as products commoditize. When all banks offer similar accounts, loans, and investment products, competitive differentiation comes from superior service delivery, faster processing, and better client experiences. AI provides the operational capabilities enabling these differentiators.

This operational focus ensures AI investments target concrete business improvements rather than pursuing technology for its own sake. Each AI deployment must demonstrate measurable impact on efficiency, quality, or capability. This discipline prevents wasting resources on flashy AI applications that don’t meaningfully improve operations.

The emphasis on continuous improvement and feedback loops also reflects operational excellence thinking. Initial AI deployments won’t be perfect. The key is learning from usage, identifying shortcomings, and iterating toward continuously improving capabilities. Organizations treating AI deployment as one-time projects miss opportunities for the compound improvements that come from sustained focus on operational enhancement.

The Training Infrastructure Investment

Making AI training mandatory for 240,000 employees globally requires substantial training infrastructure: curriculum development, delivery mechanisms, assessment systems, and ongoing support. This investment extends far beyond just purchasing AI tools.

The curriculum must address diverse roles and skill levels. Technical staff need deep training on AI capabilities, limitations, and integration approaches. Business users need practical guidance on using AI tools effectively for their specific workflows. Leadership needs strategic understanding of AI implications for their organizations.

Delivery mechanisms must scale globally while accommodating different learning preferences and constraints. Online training provides flexibility but might not work well for all audiences. In-person workshops enable hands-on practice but limit scalability. Citi likely employs blended approaches combining multiple delivery methods.

Assessment ensures training effectiveness rather than just completion. Employees must demonstrate actual AI literacy and prompt engineering skills, not just attend training sessions. This requires developing assessment methods that genuinely test capability rather than just knowledge recall.

Ongoing support addresses the reality that training provides foundation but practical proficiency develops through sustained usage. Employees need accessible resources for troubleshooting, best practice sharing, and continued learning as AI tools evolve and as they discover new applications.

The Ethical AI Commitment

Citi’s emphasis on ethical and safe AI practices reflects growing recognition that AI deployment carries risks requiring proactive governance. Algorithmic bias, privacy concerns, and potential for misuse create substantial reputational and regulatory risks if not properly managed.

The commitment to monitoring AI systems for performance, reliability, and compliance creates accountability for AI outcomes. Someone must continuously verify that AI systems operate as intended, don’t exhibit problematic biases, and comply with relevant regulations. This monitoring requires dedicated resources and clear ownership rather than assuming AI systems will remain trustworthy automatically.

The focus on safe AI practices particularly matters in financial services where AI errors could directly harm customers financially. An AI system that provides inappropriate investment advice or makes incorrect credit decisions creates direct financial damages plus regulatory liability. Ensuring AI operates safely requires extensive testing, validation, and ongoing monitoring.

The ethical AI framing also addresses workforce concerns about AI replacing jobs. Emphasizing AI as augmentation of human capabilities rather than replacement helps manage change resistance and maintains employee engagement during transformation. Workers who view AI as tool enhancing their work rather than technology eliminating their jobs approach adoption more positively.

Your Strategic Response Path

For financial institutions, Citi’s comprehensive AI deployment creates clear imperatives. The banks that implement similar initiatives quickly might maintain competitive positions. Those that delay while watching Citi build AI capabilities risk permanent operational disadvantages.

Start with concrete use cases that demonstrate measurable value. Citi’s approach focuses on productivity improvements and workflow automation that generate clear ROI rather than speculative AI experiments. Early wins build organizational confidence and funding for expanded deployment.

Invest in training infrastructure rather than assuming employees will figure out AI tools independently. Mandatory training with robust curriculum ensures workforce capability rather than hoping for organic adoption. The training investment pays for itself through more effective AI utilization.

Build governance frameworks that enable innovation while managing risks. Citi’s emphasis on continuous monitoring and compliance integration provides a model for responsible AI deployment that satisfies regulators while enabling aggressive adoption.

Develop distributed expertise through champion networks rather than centralizing AI knowledge. Domain experts who understand AI can drive adoption more effectively than AI experts who lack domain knowledge. The combination of both creates the organizational capability required for successful deployment.

The Future of Banking Operations

Banking is transitioning from labor-intensive operations to AI-augmented workflows where human expertise focuses on judgment, relationships, and complex problem-solving while AI handles routine analysis, information retrieval, and standardized processes.

Citi’s aggressive deployment positions them at the leading edge of this transformation. The banks that successfully make similar transitions will operate with fundamentally different cost structures and service capabilities than those maintaining traditional approaches.

Making AI literacy mandatory for 240,000 employees isn’t about impressive training programs. It’s about building the workforce capabilities required for the bank’s operating model going forward.