Investment banks have a dirty secret: they ignore most deals that happen in the market. Not because those deals aren’t profitable. Because the economics of traditional banking make smaller transactions financially impossible to pursue.

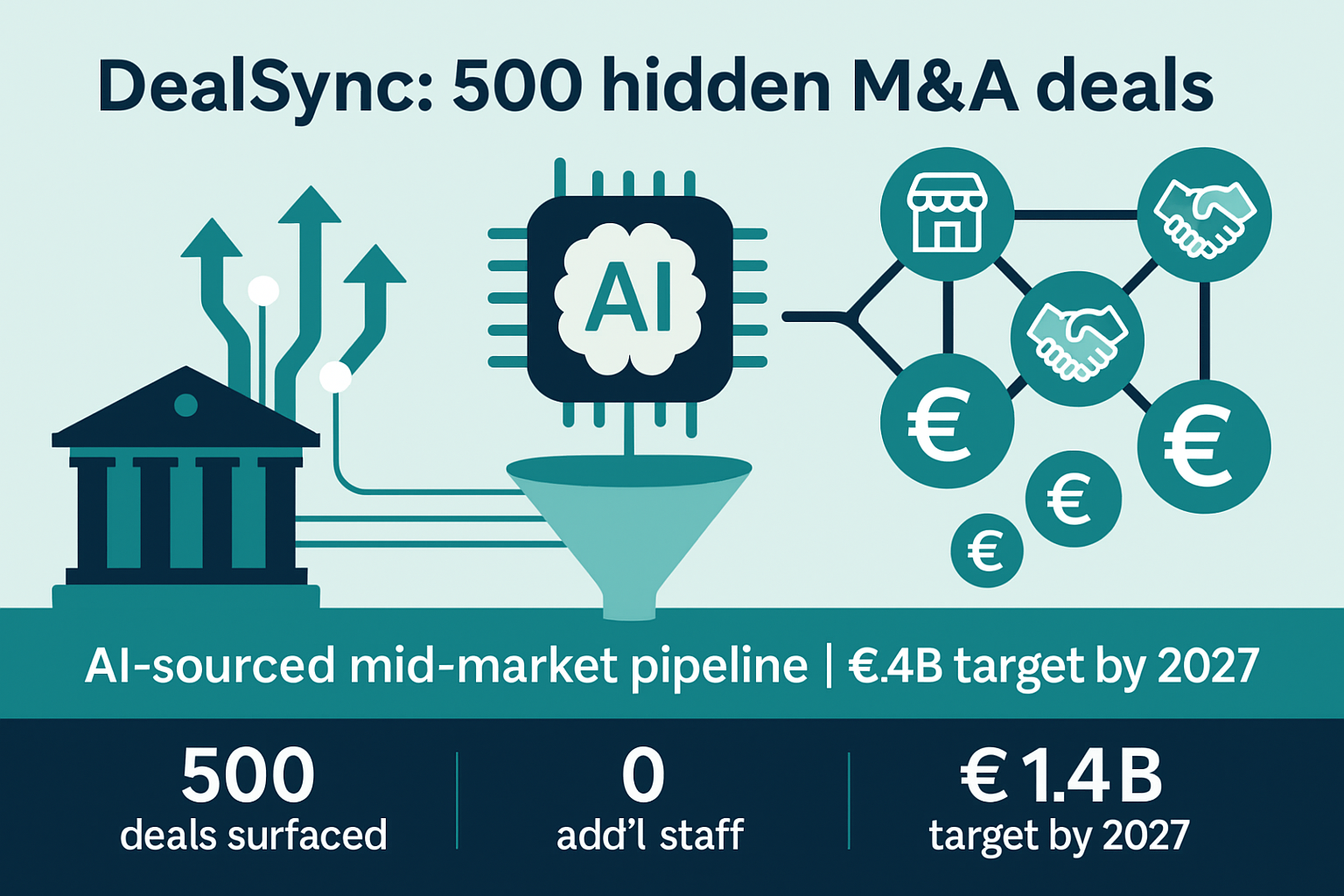

UniCredit built an AI platform called DealSync that identified 500 new M&A opportunities in less than a year. Zero additional staff required. These weren’t tiny deals either. They’re targeting €1.4 billion in additional revenue by 2027 from transactions that were always there but that traditional banking models couldn’t economically capture.

The fascinating part isn’t the technology. It’s realizing that billions in potential banking fees were sitting in plain sight, ignored by every major bank because the unit economics of human bankers made pursuing them unprofitable. Until AI changed the math entirely.

The Mid-Market Black Hole

Investment banking operates on a brutally simple equation: banker time is expensive, so deals must generate fees large enough to justify that time investment. A senior M&A banker earning $500,000 annually plus support staff, office overhead, and infrastructure costs might represent $750,000 in fully loaded annual expenses. If that banker closes 8-10 deals per year, each deal needs to generate enough fees to cover these costs plus profit margin.

For deals valued over €100 million, the math works beautifully. A 1-2% success fee on a €200 million transaction generates €2-4 million in fees, easily justifying the banker time required. These large deals get extensive attention: multiple bankers, analysts preparing detailed materials, senior executives involved in client relationships.

For deals under €50 million, the math collapses. A 1-2% fee on a €30 million transaction generates €300,000-€600,000. That sounds substantial until you calculate that it took the same banker time to source, pitch, negotiate, and close as the larger deal. The banker who could close 8-10 large deals generating €20-30 million in fees can’t profitably work on smaller deals generating a fraction of that amount.

The result is a massive market opportunity that gets systematically ignored. In Italy and Germany alone, €50-60 billion worth of SME M&A transactions happen annually, with over half valued under €50 million. These aren’t marginal businesses. They’re successful mid-market companies with willing buyers and motivated sellers. The deals would happen profitably if banks could economically facilitate them.

Traditional banking models simply wrote off this entire segment as “too small to serve profitably” despite the billions in potential fees. The assumption was that human bankers represent fixed costs that can’t scale to smaller deals. AI demolished that assumption.

The DealSync Intelligence System

UniCredit’s platform doesn’t replace human bankers. It solves the sourcing problem that made smaller deals uneconomical. Traditional deal sourcing relies on banker networks, client relationships, and market knowledge. A banker identifies potential acquisition targets through industry connections, matches them with potential buyers they know, and facilitates introductions.

This relationship-driven model works brilliantly for large deals where the fee justifies the time investment in building those relationships. It fails completely for smaller deals where the same relationship-building effort generates a fraction of the fees.

DealSync uses machine learning to systematically process vast amounts of market and company data, identifying potential M&A opportunities among small and medium-sized enterprises. The system analyzes financial performance, ownership structures, industry trends, competitive positioning, and dozens of other factors that indicate companies likely to be acquisition targets or potential acquirers.

The key innovation is automating the most time-intensive part of deal-making: identifying opportunities and matching buyers with sellers. Once DealSync surfaces a promising opportunity, human bankers can evaluate whether it merits pursuit and deploy their relationship skills on qualified leads rather than spending weeks identifying prospects.

Think of it like the difference between cold-calling every business owner hoping to find someone considering a sale versus having a system that identifies the 50 business owners most likely to sell in the next 12 months. The human banker’s time gets deployed far more efficiently when focused on qualified prospects rather than broad prospecting.

I’ve watched similar dynamics play out in enterprise software sales, where companies using AI-powered lead scoring converted prospects 3-4 times faster than those relying on manual qualification. The salespeople weren’t better. They were spending their time on higher-probability opportunities that the AI identified from analyzing thousands of weak signals that humans would miss.

The 500 Deals Discovery

UniCredit surfaced approximately 500 new M&A opportunities through DealSync as of April 2025. This number deserves closer examination because it reveals how much opportunity traditional banking was leaving on the table.

These weren’t 500 deals that UniCredit closed. They were 500 qualified opportunities that met their criteria for deals worth pursuing. Not every opportunity converts to a closed transaction. Some companies decide not to sell. Some buyers lose interest. Some negotiations fail on price or terms. A reasonable conversion rate might be 10-20%, meaning 50-100 actual closed deals from the initial 500 opportunities.

Even at the low end, that’s 50 additional deals UniCredit can pursue without adding banker headcount. If those deals average €30 million in transaction value with 1.5% success fees, that’s €22.5 million in additional revenue from transactions that were previously uneconomical to pursue.

The compounding effect matters more than the immediate revenue. Each closed deal creates a client relationship enabling cross-selling other banking services: lending, treasury management, wealth management for the selling shareholders. A €30 million M&A deal might generate €450,000 in success fees plus €100,000-200,000 annually in ongoing banking relationship revenue.

More importantly, successfully closing deals builds reputation and generates referrals. A satisfied seller refers other business owners considering sales. A successful buyer returns for additional acquisitions. The initial AI-sourced deal creates a relationship pipeline that extends far beyond the original transaction.

The €1.4 Billion Target Reality

UniCredit aims to generate €1.4 billion in additional revenue by 2027 through DealSync-enabled mid-market M&A. This ambitious target requires understanding what “revenue” means in banking context and how DealSync enables it.

The revenue isn’t just M&A success fees. It’s the total incremental banking revenue from serving mid-market clients that DealSync relationships enable. An M&A transaction introduces UniCredit to both buyer and seller, creating opportunities for:

Transaction Fees: Success fees from closed M&A deals, typically 1-2% of transaction value.

Lending Revenue: Acquisition financing for buyers, refinancing for combined entities, working capital facilities for growing businesses.

Treasury Services: Cash management, foreign exchange, interest rate hedging, and other services for mid-market companies.

Wealth Management: Private banking services for business owners who sell their companies and suddenly have significant liquid wealth to invest.

Cross-Border Services: International payments, trade finance, and foreign currency accounts for businesses expanding globally post-acquisition.

A single €30 million M&A transaction might generate €450,000 in success fees, but the buyer needs €20 million in acquisition financing generating €200,000 annually in interest revenue, the seller invests €15 million in private banking assets generating €150,000 annually in wealth management fees, and both companies use treasury services generating €50,000 annually.

The M&A deal becomes the entry point for banking relationships generating revenue multiples of the initial transaction fee. DealSync doesn’t just identify M&A opportunities. It identifies future banking clients that traditional relationship models would never reach because the initial deal was too small to justify banker attention.

The Geographic Arbitrage Opportunity

UniCredit focused DealSync initially on Italy and Germany, markets where they have strong existing presence and deep market knowledge. This geographic focus makes strategic sense for several reasons that reveal sophisticated thinking about AI deployment.

Italy and Germany have mature mid-market economies with thousands of family-owned businesses reaching generational transitions. Baby boomer founders approaching retirement often lack succession plans, creating natural motivation to sell. Their businesses are profitable and well-managed but too small for private equity’s typical minimums and too large for individual buyers.

This creates the perfect conditions for AI-powered deal sourcing: large numbers of potential transactions in a defined geographic market with common characteristics that algorithms can learn to identify. The AI can analyze patterns in Italian and German mid-market businesses that predict M&A readiness more effectively than trying to identify deals globally across diverse markets.

The geographic focus also allows human bankers to develop deep local market expertise. Understanding regional business cultures, building relationships with local advisors, and navigating country-specific regulatory requirements matters enormously in mid-market M&A. AI sources the deals, but local bankers close them using market knowledge that algorithms can’t replicate.

Starting with markets where UniCredit already has strong presence means they can test and refine DealSync in familiar territory before expanding to new geographies. Success in Italy and Germany proves the model works, building confidence for expansion into other European markets where similar mid-market opportunities exist.

The Data Flywheel Effect

Each deal DealSync identifies creates training data that makes the system more effective at identifying future deals. This virtuous cycle creates compounding advantages that become increasingly difficult for competitors to replicate.

When DealSync flags a company as a potential acquisition target and that company subsequently gets acquired (whether through UniCredit or competitors), the system learns what signals predicted that transaction. It refines its understanding of which financial metrics, ownership structures, industry conditions, and other factors indicate M&A readiness.

When DealSync identifies a promising opportunity that doesn’t convert to a transaction, the system learns from that too. Maybe the company’s financial performance looked attractive but family ownership dynamics made a sale unlikely. The AI incorporates these learnings, improving its ability to filter out opportunities that look promising on paper but won’t convert in practice.

This feedback loop means DealSync becomes more accurate over time, surfacing higher-quality opportunities while filtering out false positives that waste banker time. The hit rate improves, meaning bankers spend more time on deals that close and less time on prospects that ultimately don’t proceed.

Competitors starting similar AI initiatives in 2025 lack the training data UniCredit has accumulated through 2023-2024 deployments. Even if they use identical technology, their systems will be less accurate because they haven’t learned from hundreds of real opportunities. This data advantage compounds: UniCredit’s system gets better faster because it sees more deals, creating a growing gap with later entrants.

The Banking Economics Revolution

DealSync fundamentally changes the unit economics of investment banking by dramatically reducing the cost of deal sourcing. Traditional models require expensive human bankers to identify opportunities through relationship building and market coverage. DealSync automates sourcing, allowing bankers to focus their time on higher-value activities like client relationships and deal execution.

Consider the time allocation of a traditional M&A banker:

- 40% prospecting and deal sourcing

- 30% pitch preparation and client meetings

- 20% deal execution and negotiation

- 10% relationship maintenance

DealSync eliminates most of the 40% spent on prospecting, allowing bankers to redeploy that time to working on more deals simultaneously. A banker who could previously handle 6-8 deals annually might now handle 10-12 because sourcing is handled by AI.

This doesn’t mean individual bankers generate 50% more revenue. It means the bank can profitably serve a segment (sub-€50 million deals) that was previously uneconomical because the cost structure didn’t support it. The same banker headcount can now profitably work on deals that previously didn’t justify their time.

The productivity improvement also changes hiring economics. Junior bankers traditionally spent significant time on prospecting activities to develop market knowledge and build dealflow. With AI handling sourcing, junior bankers can focus on developing deal execution skills, potentially accelerating their development while reducing the time senior bankers spend training them.

The Competitive Response Problem

UniCredit’s public disclosure of DealSync creates a dilemma for competitors. They now know AI-powered deal sourcing works and generates measurable returns. The question becomes how quickly they can implement similar capabilities before UniCredit’s first-mover advantage becomes insurmountable.

Building comparable systems requires several elements that take time to assemble:

Data Infrastructure: Systems capturing and organizing market data, company financials, ownership structures, and transaction histories that feed the AI models.

AI Expertise: Teams capable of building and training machine learning models for deal identification, requiring both data science skills and M&A domain knowledge.

Process Integration: Workflows connecting AI-generated leads to banker coverage models, CRM systems, and deal management processes.

Cultural Change: Training bankers to trust and act on AI-generated leads rather than relying exclusively on their traditional relationship networks.

Competitors face a minimum 12-18 month implementation timeline even with aggressive investment. During that time, UniCredit continues refining DealSync, accumulating training data, and closing deals that generate client relationships. The gap widens rather than narrows.

Some banks will attempt to shortcut this by licensing third-party AI platforms rather than building proprietary systems. This provides faster deployment but lacks the customization and proprietary data advantages of purpose-built platforms. They’ll have AI capability but potentially less effective than UniCredit’s tailored system trained on their specific market focus.

The Relationship Banking Synergy

Mid-market M&A creates particularly strong relationship banking opportunities because the companies and individuals involved typically need comprehensive banking services. This differs from large corporate M&A where buyers and sellers often already have established banking relationships.

A mid-market business owner selling their company for €30 million suddenly has significant liquid wealth requiring investment management. They’ve spent 20-30 years building the business with most personal wealth tied up in company equity. Post-sale, they need wealth management, tax planning, estate planning, and investment advice.

The buyer acquiring that business needs financing, potentially their first institutional lending relationship if they’re coming from a smaller company. They need treasury services as they scale operations. They may need foreign exchange services if the acquisition enables international expansion.

Both parties need M&A advisory services for future transactions. A successful seller might make angel investments or acquire other businesses. A successful buyer will likely pursue additional acquisitions to continue growing through M&A.

DealSync doesn’t just generate M&A fees. It creates entry points for comprehensive banking relationships with mid-market clients who become increasingly valuable over time as their wealth and business activities grow.

The Technology Stack Reality

DealSync’s effectiveness depends on sophisticated data collection and analysis that goes far beyond simple algorithmic matching. The system likely integrates multiple data sources and analytical approaches:

Financial Data Analysis: Parsing company financial statements, growth rates, profitability metrics, and balance sheet strength to identify attractive acquisition targets.

Ownership Intelligence: Tracking ownership structures, shareholder agreements, and family dynamics that influence willingness to sell.

Industry Trends: Analyzing sector consolidation patterns, regulatory changes, and competitive dynamics that create M&A motivations.

Buyer Profiling: Identifying companies with acquisition appetites based on their growth strategies, available capital, and historical M&A activity.

Sentiment Analysis: Monitoring news, social media, and other public information for signals indicating M&A interest.

Network Analysis: Mapping relationships between companies, investors, and advisors to identify natural buyer-seller matches.

The AI doesn’t use a single algorithm but combines multiple analytical approaches to generate comprehensive opportunity assessments. A company might score highly on financial attractiveness, ownership dynamics, and industry consolidation trends, making it a high-probability target worth banker attention.

The Risk Management Layer

Deploying AI for deal sourcing requires careful risk management because false positives waste expensive banker time while false negatives miss valuable opportunities. UniCredit likely implemented multiple mechanisms to balance these competing risks:

Confidence Scoring: The AI assigns probability scores to opportunities, allowing bankers to prioritize high-confidence leads while optionally reviewing lower-confidence possibilities during slow periods.

Human Validation: Bankers review AI-generated leads before client outreach, applying judgment about relationship appropriateness and timing.

Feedback Loops: Bankers indicate which leads converted successfully and which didn’t, training the AI to improve its identification accuracy.

Threshold Tuning: The system can adjust sensitivity, generating more leads (higher false positives) or fewer, higher-quality leads (potential false negatives) based on banker capacity and conversion rates.

This layered approach allows UniCredit to capture AI efficiency benefits while managing the reality that algorithmic deal identification will never be perfectly accurate. The goal isn’t perfection but generating a better opportunity pipeline than traditional relationship-based sourcing, which is a relatively low bar given how much of the mid-market was previously unsourced.

The Market Timing Advantage

UniCredit launched DealSync during a period when several trends aligned to make mid-market M&A particularly attractive:

Demographic Transition: Baby boomer business owners reaching retirement age without succession plans.

Private Equity Interest: PE firms launching continuation vehicles and seeking smaller deals as competition intensifies for larger targets.

Digital Transformation: Mid-market companies needing capital and expertise to digitize operations, making them attractive targets for tech-savvy acquirers.

Supply Chain Reshoring: European companies acquiring suppliers to secure supply chains, increasing demand for manufacturing acquisitions.

Regulatory Pressure: Sustainability regulations creating consolidation opportunities as smaller companies struggle with compliance costs.

These converging trends created a particularly rich environment for mid-market M&A just as UniCredit deployed AI tools to capture it. The timing wasn’t necessarily deliberate but created favorable conditions for DealSync to prove its value quickly.

The Talent Implications

DealSync changes the skills profile for successful M&A bankers. Traditional bankers excelled at relationship building, network development, and market knowledge accumulated over decades. DealSync-enabled bankers need different capabilities:

AI Literacy: Understanding how the system identifies opportunities and how to interpret confidence scores and recommendations.

Qualification Speed: Rapidly evaluating AI-generated leads to determine which merit pursuing rather than spending weeks developing each relationship.

Execution Focus: Deeper expertise in deal structuring, negotiation, and closing since sourcing is handled by AI.

Data Interpretation: Reading the signals and patterns that AI identifies rather than relying purely on intuitive market knowledge.

This doesn’t mean traditional relationship banking becomes irrelevant. The best bankers will combine AI-driven sourcing with relationship skills to close deals efficiently. But the relative importance of different skills shifts, and banks must adjust training and recruitment accordingly.

Your Strategic Response Path

For banks in investment banking or mid-market M&A, UniCredit’s success creates pressure to develop similar capabilities. The companies that implement AI-powered deal sourcing in 2025-2026 will build competitive advantages that compound over time. Those still relying exclusively on traditional relationship banking will find themselves systematically losing market share in mid-market segments.

Start by assessing your current mid-market coverage. How many potential deals under €50 million are you missing because they don’t justify traditional banker economics? That gap represents your addressable opportunity if you can reduce sourcing costs through AI.

Invest in data infrastructure before worrying about specific AI algorithms. The quality of AI-generated leads depends entirely on data quality. Banks with comprehensive market data, company intelligence, and transaction histories will build more effective systems than those with fragmented data.

Partner with AI firms if building proprietary systems internally is impractical. Third-party platforms won’t provide the same customization as purpose-built systems but can deliver 70-80% of the value at a fraction of the development cost and time.

Prepare your bankers for AI-augmented workflows. The cultural change from relationship-driven sourcing to AI-generated leads requires training, process changes, and new performance metrics focused on conversion rates rather than pure relationship building.

The Future of Investment Banking

Investment banking is fragmenting into two distinct models: relationship-intensive coverage of large complex deals where human judgment remains essential, and AI-augmented coverage of smaller transactions where technology enables profitable serving of previously ignored segments.

The banks that build capabilities in both models will capture the broadest market opportunity. Traditional relationship banking for large deals, AI-enabled sourcing for mid-market transactions, creating comprehensive coverage across deal sizes.

UniCredit proved that billions in M&A fees were sitting in plain sight, ignored by traditional banking models because the unit economics didn’t work. AI didn’t create new deals. It made existing deals economically viable to pursue.

The question isn’t whether AI will transform mid-market M&A. It’s whether your bank will lead or follow in capturing the opportunity.

Finding 500 hidden deals isn’t impressive technology. It’s impressive economics. That’s what changes industries.